At its core, an invoice is not just a piece of paper or a digital notification; it’s a vital instrument that facilitates the smooth operation of business activities, ensuring that companies can track their sales and services while maintaining a healthy cash flow. So, when we delve into the question, “What is an invoice,” we’re exploring a fundamental element that bridges the gap between delivering goods or services and receiving compensation.

What is an Invoice?

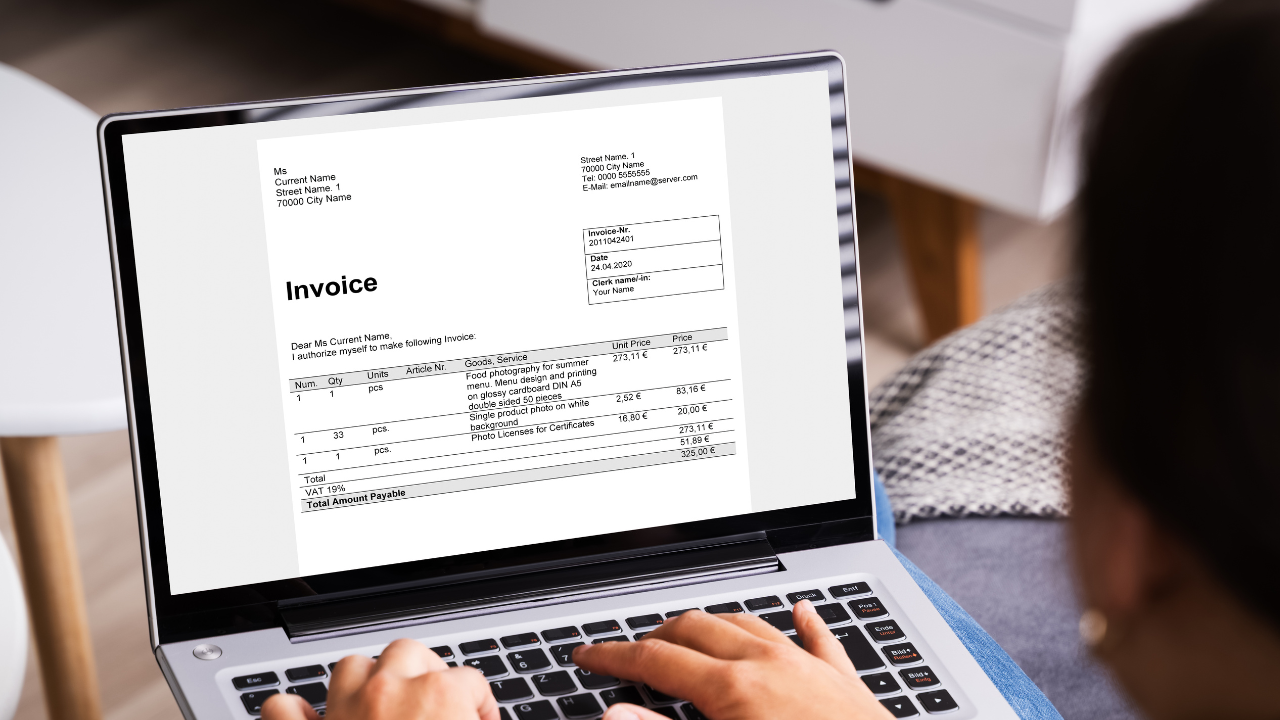

An invoice is a formal, structured document that serves a critical role in the business and accounting world. It’s essentially a formal request for payment, issued by a business to its customer following the provision of goods or services. An invoice outlines the transaction’s specifics, detailing what was provided, how much is owed, and when the payment is due.

Key components of an invoice include:

- Transaction Details: These encompass a description of the goods or services provided, allowing the recipient to understand exactly what they’re being charged for.

- Invoice Number: The invoice number is a unique identifier for each invoice, which is crucial for record-keeping and tracking purposes.

- Payment Terms: This section specifies how long the customer has to make the payment and may include preferred payment methods.

- Contact Information: Details of both the issuer and the recipient, including names, addresses, and contact numbers, ensure clear communication channels.

By integrating these elements, an invoice not only requests payment but also serves as a legal document that can be used for accounting purposes and, if necessary, in legal proceedings to ensure payment is made.

Types of Invoices

In the diverse landscape of business transactions, various types of invoices are employed to cater to different needs and scenarios. Understanding these types is crucial for managing the process effectively, ensuring that your business communicates clearly and collects payment efficiently.

| Type of Invoice | Description |

|---|---|

| Pro Forma Invoice | A preliminary bill of sale, not a request for payment but an estimation, commonly used in international trade to outline expected costs for goods and services. |

| Sales Invoice | Issued post-sale to request payment, recording revenue and managing inventory, detailing products, prices, and the total amount due. |

| Itemized Invoice | Breaks down the total cost, listing each good or service with individual pricing, providing clarity and detail for both parties involved. |

| Recurring Invoice | Automatically issued at set intervals for ongoing services, facilitating regular payment collection and expense anticipation for the customer. |

| Credit and Debit Invoice | Credit invoices decrease the amount owed by a customer, typically for returns or refunds, while debit invoices increase the amount due, usually for additional charges or corrections to an initial invoice. |

| Open Invoice | An issued invoice that remains unpaid, important for tracking in accounts receivable to maintain financial health and pursue timely collections. |

Pro Forma Invoice

A pro forma invoice is essentially a preliminary bill of sale. It’s issued before the delivery of products and is particularly common in international trade. This type of invoice provides the buyer with a clear idea of what to expect regarding the goods, services, and associated costs. It’s not a request for payment but rather an estimation, helping both parties align their expectations and prepare for the actual transaction.

Sales Invoice

Sales invoices are a staple in the business world. Once a sale is completed, this invoice is generated to request payment from the customer. It’s a critical document for accounting, as it records revenue and manages inventory. This invoice includes details about the products provided, their prices, and the total amount owed, serving as a record of the transaction for both the seller and the buyer.

Itemized Invoice

An itemized invoice breaks down the total cost into detailed listings of each provided good or service, including individual pricing. This clarity is beneficial for both the issuer and the recipient, as it provides a transparent account of what is being charged, enhances the understanding of the total cost, and assists in verifying the accuracy of the charges.

Recurring Invoice

For ongoing services, this invoice is a boon. It’s automatically issued at regular intervals, such as monthly or annually, to request payment for continued service. This automation streamlines the billing process, making it easier for businesses to collect payment regularly and for customers to anticipate their expenses.

Credit and Debit Invoices

A credit invoice is issued to reduce the amount a customer owes, often due to a return or a refund. On the flip side, a debit invoice increases the total amount due, typically arising from additional charges or corrections to an underbilled invoice. These invoices ensure that the billing accurately reflects the value of products exchanged.

What is an Open Invoice?

An open invoice is one that has been issued but remains unpaid. Managing open invoices is crucial for effective accounts receivable operations. Keeping track of these invoices helps businesses monitor their revenue stream, understand their financial standing, and pursue timely collection efforts to maintain financial health.

What is an Invoice Used for?

While the primary purpose of an invoice is to request payment, its utility spans several critical aspects of business operations. Beyond being a bill, an invoice is a multifunctional tool that plays a pivotal role in several areas:

- Bookkeeping Accuracy: Invoices provide a detailed record of transactions, essential for accurate and efficient bookkeeping. They help track sales, monitor inventory, and record expenses, forming the backbone of financial reporting.

- Legal Documentation: An invoice serves as a legally binding document that can be used in disputes or legal proceedings to establish the terms of a transaction and ensure that obligations are met.

- Cash Flow Management: By detailing terms of payment and deadlines, invoices help businesses manage their revenue stream, ensuring they have the necessary funds on hand for their operational needs.

Invoicing Process

The invoicing process is an essential component of the financial operations within a business, ensuring that transactions are accurately recorded, and payments are received for goods or services provided. This systematic approach not only facilitates better cash flow management but also contributes to maintaining healthy customer relationships through clear and professional communication. The steps involved in this process are outlined below:

- Creating the Invoice: The first step involves the compilation of all relevant information that needs to be included in the invoice. This typically includes a detailed description of the products or services rendered, the quantity, the price per unit, and the total amount due. Additionally, it’s important to include the date of the invoice, a unique invoice number for tracking purposes, and both the vendor’s and the customer’s contact information, such as names, addresses, and phone numbers. Tax information, if applicable, should also be clearly stated. You can also look at invoice examples or use a printable invoice template for more guidance on how to create an invoice. Check out our invoice example to get started.

- Issuing the Invoice: Once the invoice is prepared and double-checked for accuracy, it needs to be sent to the customer. This step has evolved with technological advancements, and while traditional mail is still used, electronic invoicing (e-Invoicing) is becoming the norm due to its efficiency and eco-friendliness. Emailing invoices or using dedicated invoicing platforms can expedite the process, ensuring the invoice reaches the customer promptly. It’s crucial to use the customer’s preferred delivery method to avoid delays.

- Payment Tracking: After issuing the invoice, it’s essential to keep an eye on its status. This involves monitoring due dates and ensuring that the invoice doesn’t fall through the cracks. Many businesses use accounting or invoicing software that allows for automatic tracking of payment statuses. If an invoice is nearing its due date or becomes overdue, sending polite reminders to the customer can be an effective way to prompt payment. Maintaining a balance between persistence and courtesy is key to managing this step effectively.

- Receipt of Payment: The final step in the invoicing process occurs when the payment is received. It’s important to promptly verify that the payment matches the invoiced amount and to record the transaction in the business’s financial systems. Recording payments accurately is crucial for maintaining up-to-date financial records and for reconciliation purposes. Following the receipt of payment, sending a thank-you note or a payment acknowledgment to the customer can be a good practice, reinforcing positive relations and confirming the transaction’s completion.

By adhering to these steps, businesses can manage their invoicing process efficiently, leading to improved cash flow, reduced errors, and enhanced customer satisfaction.

Electronic Invoicing

Electronic invoicing, often referred to as e-Invoicing, represents a significant advancement in financial transactions and business operations. This digital approach to invoicing harnesses the power of technology to streamline the entire billing process, making it faster, more accurate, and environmentally friendly compared to traditional paper-based methods. The key aspects of electronic invoicing include the following:

- Creation of Electronic Invoices: Utilizing invoicing software or specialized platforms, businesses can generate digital invoices that include all the necessary details such as descriptions of goods or services, quantities, prices, tax information, and total amounts due. These digital invoices can also be customized to match the branding of the business, including logos and color schemes, enhancing the professionalism of the communication.

- Efficient Sending and Receiving: E-Invoices can be sent directly to customers via email or through a secure online portal, significantly reducing the delivery time associated with postal services. Customers receive these invoices instantaneously, which can lead to faster review and processing times on their end as well.

- Error Reduction: With electronic invoicing, many processes that were traditionally done manually, such as calculations and data entry, can now be automated. This automation drastically reduces the chances of human error, leading to more accurate invoicing and reducing the time spent on corrections and reconciliations.

- Cost Savings: By adopting e-invoicing, businesses can eliminate the costs associated with paper, printing, and postage. Additionally, the time savings translate into cost savings, as staff can allocate their time to more value-adding activities rather than administrative tasks.

- Environmental Benefits: E-invoicing is an eco-friendly alternative to paper invoices. By reducing the need for paper and printing supplies, businesses contribute to the conservation of resources and the reduction of their carbon footprint.

- Enhanced Tracking and Management: Invoicing software typically includes features for tracking the status of invoices, sending automatic reminders for upcoming or overdue payments, and generating reports. These features provide businesses with greater visibility into their accounts receivable and can help improve cash flow management.

- Improved Security: Digital invoices can be encrypted and securely stored in the cloud, offering better protection against loss, theft, or damage compared to physical invoices. Additionally, access controls can ensure that only authorized personnel can view sensitive financial information.

- Regulatory Compliance: Many e-invoicing platforms are designed to comply with regional and global regulatory requirements, including tax reporting standards. This compliance is crucial for businesses operating in multiple jurisdictions or those that need to adhere to specific industry standards.

- Integration with Accounting Systems: Electronic invoices can be easily integrated into existing accounting or enterprise resource planning (ERP) systems. This integration allows for the seamless flow of data, reducing manual data entry and improving the overall efficiency of financial management.

- Global Accessibility: With e-Invoicing, invoices can be sent and received from anywhere in the world, facilitating international business transactions and supporting companies with a global customer base.

By embracing electronic invoicing, businesses can achieve a more streamlined, efficient, and sustainable invoicing process, ultimately leading to improved operational efficiencies and customer satisfaction.

Invoice Payment Terms

Invoice payment terms specify when the payment is due and can significantly impact business operations and revenues. Common terms include:

- Net 30: Payment is due 30 days after the invoice date.

- Due Upon Receipt: Immediate payment is required once the invoice is received.

- Early Payment Discounts: Incentives for paying before the due date.

Pro Tips for Managing Invoices

Effective invoice management is key to maintaining a smooth financial operation:

- Utilize Invoicing Software: Automate and streamline the prodecure, especially for generating electronic invoices and managing recurring invoices.

- Set Clear Payment Terms: Clearly define when and how you expect to be paid to avoid misunderstandings.

- Proactive Follow-Up: Regularly monitor and follow up on outstanding invoices to ensure timely payments.

- Invoice Factoring: Consider using invoice factoring or invoice financing to get advance payments on your receivables, improving the flow of cash.

What is an Invoice? Essential Takeaways

An invoice is more than just a bill; it’s a crucial component of business operations, aiding in legal documentation, bookkeeping, and revenue stream management. Understanding different types of invoices, the invoicing procedures, and effective management practices can help you getting paid on time and significantly enhance a business’s operational efficiency and financial stability. Remember, effective invoicing is integral to a business’s success, streamlining transactions and fostering strong customer relationships.

Image: Envato Elements

This article, “What is an Invoice? Types and Advice” was first published on Small Business Trends